It seems cryptocurrency scams have been thriving since the day Bitcoin went public. As soon as the revolutionary new technology rolled out, scammers rose to the challenge. They’ve been tricking people and stealing their hard-earned funds ever since.

That’s why we’ve made this guide on how to recognize cryptocurrency scams and what you can do to avoid them. As a crypto investor, you can reference it before you put your money into a scheme that looks too good to be true.

The impact of cryptocurrency scams

In a young industry like cryptocurrency, it can be difficult to differentiate between a promising project and a scam. New coins and aggressive promotions surface every other day. Some of these are legitimate, while others are just cleverly disguised scams. Many investors and businesses have lost a lot of money to these scams. Some have even gone bankrupt.

Take the case of initial coin offerings (ICOs), where one of the largest frauds in crypto history took place. A Vietnamese firm called Modern Tech held a fundraiser and gathered around $660 million for two tokens: Pincoin and iFan. Modern Tech promised an efficient P2P platform to enable online transactions in crypto. Using multi-level marketing campaigns, the company raised a huge amount of money. However, the firm never gave investors their tokens.

Another famous scam was BitKRX, a Korean “exchange” that claimed to be a branch of a famous crypto business called KRX. In 2017, many clients reported that BitKRX had stolen their funds. The BTC they supposedly purchased had vanished without a trace. Nobody knows how much BitKRX stole, although it surely measures in the millions.

Types of cryptocurrency scams

Cybercriminals use a range of tricks to con victims out of their money. Sometimes they even pretend to have connections with legitimate businesses, as in the case of KRX. Here are the most common types of cryptocurrency scams to look out for.

1. Fake exchanges

As we learned from BitKRX, it’s easy to open an online exchange, pretend to sell BTC, then disappear with the money. Some do this by pretending to be a well-known legitimate business. Others offer incentives and exchange rates that are too good to be true.

2. ICO frauds

Another common cryptocurrency scam is for “businesses” to present an awesome idea, then crowdfund using an ICO. These fake businesses then take that money and never deliver what they promised. Some ICO scams are simple; the owners simply run away with the money. However, some are sophisticated, bragging about real dev teams, offices, events, and awards, only to disappear the next day.

3. Crypto Ponzi schemes

Getting others to promote your site and make money at the same time is an old trick. These Ponzi schemes usually rely on potent marketing that generates a lot of hype. Investors who come in late have to pay existing investors to take part in the program.

4. Artificial traffic/wave trading

Some trade platforms create artificial orders to make their project look more popular than it is. In these cases, bots make a huge number of transactions everyday, making it look like people are using the platform. Unsuspecting investors might then believe they’re getting involved in a legitimate business.

5. Pump & dump

This scam first occurred in traditional stock markets and has been around for decades. Nowadays, it’s wreaking havoc on the crypto market. A leader creates a group, designs a plan, and makes everyone buy or sell a cryptocurrency (usually a new one). The goal is to artificially raise then drop its price. The trouble is that this lasts for a very brief time; no more than a few seconds. The leader stands to benefit the most, while everyone else loses money the instant the price goes back to normal. No one has time to react – except the master of the scam, that is.

6. Mining pool scams

These scams came to life pretty much as soon as Bitcoin did. Someone creates a mining pool, invites others with promises of large returns, then hacks those computers and farms their hash power. The scammer uses the pool’s power to gain block after block and keep all the earnings, while the others remain empty-handed.

Recognizing a scam

Now that you know about the various cryptocurrency scams, it’s time to learn how to recognize one before it’s too late. Part of this process involves looking out for the common warning signs. However, it’s also worth listening to your own intuition. After all, there are no guarantees, even if you thought you’d covered all the basics.

Check who owns the platform

Do some research own the owner. See if they have any previous experience in the field, and work out where the business is located. Make sure they’ve acquired all the necessary licenses to start doing businesses. Once you can put a face to the company, you’ll have a better idea of whether or not it’s legitimate.

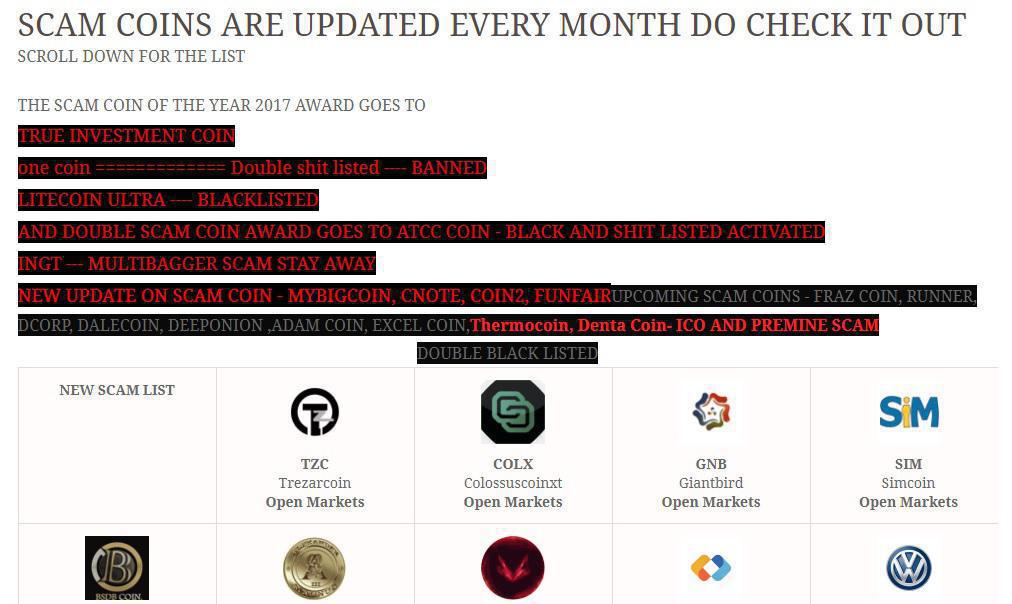

Check online forums

Community forums allow investors to express their experiences about a particular project. If you’re considering investing in a new platform that promises a lot of cool things, check out its forums first. You can also look for other online materials, such as news articles and the company’s social media accounts. Once you’ve read information from a range of sources, you can get an overall picture of the project’s legitimacy.

Analyze the business model

Put yourself in the business owner’s shoes. Does the platform/ICO offer promotions and bonuses that don’t make sense business-wise? If those mind-boggling promises sound too good to be true, they probably are. Don’t let them suck you in, or you could lose your entire investment.

Is the company doing what it says it will?

There have been a number of exit scams in the crypto world. This occurs when the platform, which seems to be working smoothly, starts to withdraw from the market. In many of these instances, investors lose all their money while the company lays the blame on a few employees.

What kind of messages do promoters use?

It’s quite common these days to see generic posts on social media about a particular crypto business or ICO. These could be bots and scammers providing fake information and spamming the community to gain publicity. Go with your instincts; if you see a message that seems fake, consider it to be a big red flag.

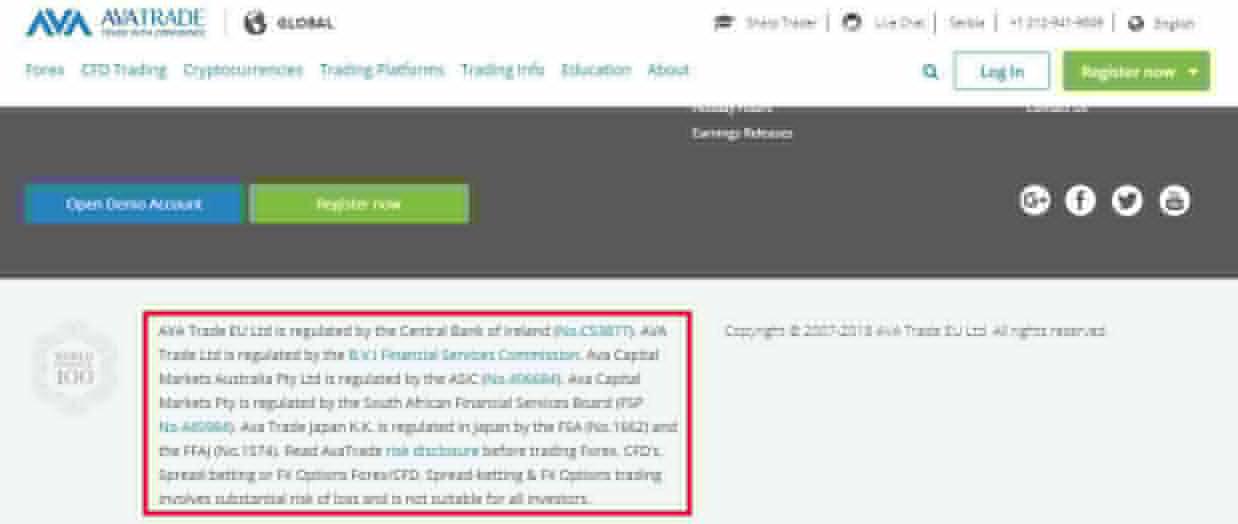

Check the company’s licenses on government databases

Some firms might provide fake documentation to prove their legitimacy. Check out the relevant government databases to confirm that this documentation is genuine. If the paperwork isn’t there, you can practically that the business is a cryptocurrency scam.

Avoid projects that only accept large investments

In many cases, ICOs or crypto platforms asking for large investments through fixed programs are simply looking for a quick way to get money and disappear. This scam is especially common among ICOs and cloud mining services.

Conclusion

Given that the crypto industry is still very new and largely unregulated, many scammers have succeeded in earning quick money from other people’s gullibility. We hope this article has helped you learn how to spot and avoid cryptocurrency scams before it’s too late. After all, it’s better to take your time researching than to rush into an investment and regret it later.

Of course, some projects are no-brainers; you can see they’re scams from a mile away. Just look at this promotion for a “great” crypto project called Bitconnect:

Would you buy this coin? If your answer is YES then, please, read this article again.

1 comment

Really good advice- I ALMOST fell for Bitconnect, but figured it was “too good to be true”, and it was. I only do stuff that I have withdrawn from and other people too, no more even looking at Ponzi scheme stuff anymore. Or questionable trade exchanges as well. Good read, thank you for the article, even though I don’t or will not do any of these kinds of promotions- it’s still good to know. http://www.top-crypto-reviews.com