Well, we’re here: 10 years of bitcoin, gone in a flash. Since the release of the bitcoin whitepaper, crypto has come a long way along an extremely bumpy road. The industry has faced plenty of challenges, but we’re finally starting to see blockchain and crypto making an impact in the real world.

Now there’s one question on everybody’s mind: What does the future hold? Let’s take a look at bitcoin’s history, as well as the current market situation, to predict what might happen over the next 10 years of bitcoin.

The humble beginnings

The crypto world has evolved dramatically since October/November 2008. But for all the change, some things have remained the same during 10 years of bitcoin. Satoshi Nakamoto is still an unknown figure, the market is volatile as ever, and everyone still wishes they’d bought 10,000 BTC for $50. In May 2010, for that same incredible sum of bitcoins, Laszlo Hanyecz made first-ever crypto pizza purchase. It took another year for bitcoin to grow from basically nothing towards $1.

Then, bitcoin got drunk, with frequent and substantial (read violent) price fluctuations. In July 2011, bitcoin experienced a large bull run, going from $1 to $31 per coin. Within a few months it went back down to $2, just as fast. It took another two years to experience the next significant growth spurt, with bitcoin skyrocketing to over $1000 in value. After that tremendous milestone, bitcoin went on pause for several years, not reaching its peak again until 2017.

It wasn’t just the price, however, that told bitcoin’s story. The number of transactions has also grown exponentially over 10 years of bitcoin, from 1000 transfers per month to 10 million in 2018. Adoption also grew; CoinMap shows a steady increase from 1000 businesses in 2013 to 10,000 in 2018. However, there’s still a long way to go, with only a small fraction of companies accepting and using bitcoin.

There was no shortage of controversy, either. China banned its banks from dealing with cryptos in 2013, several large-scale scams occurred, and BitInstant was … well, the less said about BitInstant, the better. The Mt.Gox scandal, however, was the first major warning sign for investors. Many online wallet-holders were given a reality check when more than US$450 million was stolen from the exchange. The tough news continued; in 2016, the network rate exceeded 1 exahash/sec, signifying the rise of mining difficulty.

The rise of altcoins

The first ever altcoin – namecoin – arrived in 2011, with litecoin and peercoin following shortly. However, it was in 2013 and 2014 that altcoins truly exploded, coinciding with bitcoin’s growth. Ethereum was the first major altcoin success story, setting the market on fire in 2013. All of these coins based their blockchain technology on decentralized networks, much like bitcoin.

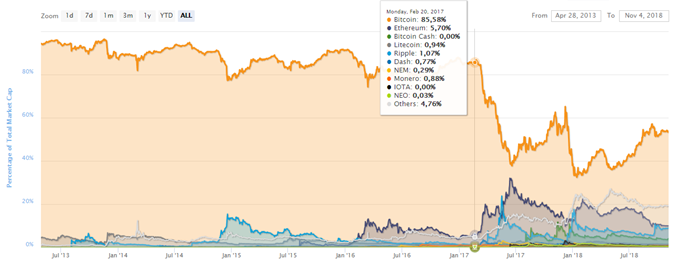

Now, some of these altcoins are competing with the king of the market for the top spot. Well second place, anyway. While bitcoin still reigns supreme in terms of value, Ethereum’s smart contract technology has brought many other coins/tokens to life. The competition is fierce, with bitcoin’s market domination rate slowly decreasing in favor of new coins.

The 2017 boom

The biggest milestone in bitcoin’s history took place in 2017. It’s perhaps the best indicator of the coin’s future behavior – at least investors hope it is. The SegWit soft fork, alongside Japan’s formal legalization of bitcoin, pushed the cryptocurrency into an unprecedented bull run. Its value then jumped in August 2017 thanks to the bitcoin cash fork. These increases led speculators to invest huge money into the coin. After all, its limited market supply (max 21 million bitcoins) had become a significant factor.

All of the above pushed the price past $20,000 at one point, surpassing all expectations. Altcoins also rode that wave, surging in value thanks to bitcoin’s influence. But as they say, what goes up must come down.

The party days of 2017 ended abruptly, and the market was left nursing a painful hangover in 2018. Of course, that bear run was natural (and quite expected), but it still hurt. Bitcoin is now tottering around the $6300–$6500 price range, with little indication of what’s in store.

The next 10 years of bitcoin

We now find ourselves in a period of price stagnation, much like we were between 2014 and 2016. However, there are a few important differences between then and now. In 2018, everyone knows about bitcoin or has at least heard about it. There are many more miners, network fees are high enough, and many new players have entered the trading arena. Hype no longer controls bitcoin’s price, and the increasingly complex industry is getting more stable.

So, what’s next? It’s tough to say for sure, but there are a few indicators that suggest bitcoin will continue to grow. Firstly, programmers and crypto writers have finally begun to concentrate their energy on development rather than promotion. Adoption is still quite low, due to bitcoin’s complexity and the long waiting time for transfers. But when you consider the possibility of exchange-traded futures (ETFs) in the U.S. and Bakkt in 2019, the future looks bright.

Incoming development and new players signify progress

Currently, dev teams are working on speeding up bitcoin transactions using the Lightning Network. Getting rid of the transaction limit (one transfer per 10 minutes) is also crucial. Once that happens, we can be sure massive adoption will occur.

Bitcoin’s price is a different matter. There could be a major bull push in 2020 when the block rate halves to 6.25 BTC, as the smaller supply would push prices up. That would, of course, help the coin get back to its peak value of US$20,000. But don’t hold your breath; we might have to wait several years to see that peak again. After all, hype and competition no longer have the effect they used to.

What matters most is the number of users working with the coin and the long-term success of their projects. The more people and businesses that adopt bitcoin, the healthier the crypto world will be.

The first 10 years of bitcoin have been a bumpy ride, but we’ve achieved much more than most people expected. There’s no reason why the next 10 years of bitcoin won’t be just as exciting, and even more successful.

What are your thoughts about the future of bitcoin? Share in comments!

1 comment

Greetings! Very helpful advice within this post!

It is the little changes that produce the most important changes.

Many thanks for sharing!